Advancing Malaysia, for the Long-Term

Khazanah Nasional Berhad is Malaysia’s sovereign wealth fund. Incorporated as a public limited company by Shares on 3 September 1993 and commenced operations in 1994, we are owned by the Minister of Finance (Incorporated), with the exception of one share held by the Federal Lands Commissioner (Incorporated).

We invest across all levels of the Malaysian economy – from listed Malaysian companies to emerging sectors, as well as internationally across markets, asset classes, sectors and geographies

Our Purpose

Investing to deliver sustainable value for Malaysians

Sitting at the nexus of the Government, private sector and rakyat (community) of Malaysia, we play an important role in developing the nation, driven by our focus and strategy in Advancing Malaysia.

While our foremost aim is to deliver strong long-term risk-adjusted returns across our portfolio, the unique position we occupy in the nation endows us with a greater purpose. We also play a role in catalysing the growth of emerging sectors and companies within the nation, contributing towards the nation’s longterm competitiveness and prosperity, and building more vibrant communities for all.

Ultimately, our activities and investments are anchored towards delivering long lasting impact towards a better Malaysia, responsibly.

Advancing Malaysia, for Long-Term

Four Strategic Imperatives to deliver our purpose.

Our Strategic Imperatives guide our thoughts and actions, providing steer towards fulfilling our purpose as Malaysia’s sovereign wealth fund and a Government-Linked Investment Company (GLIC).

Khazanah will undertake four key initiatives to deliver impactful outcomes for the nation

through Advancing Malaysia.

Click the number below to view more

Dana Impak

Dana Impak (our impact fund) is a RM6 billion commitment over five years to invest in catalytic sectors that will increase the nation’s competitiveness and build its resilience. Investments under Dana Impak are guided by six themes:

- Digital Society and Technology Hub

- Food and Energy Security

- Decent Work and Social Mobility

- Quality Health and Education for all

- Building Climate Resilience

- Competing in Global Markets

Active Corporate Player

We participate in Malaysia’s capital markets as an active shareholder, encouraging our investee companies to create value by crowding-in new private investments and driving regulatory improvements, all while promoting the adoption of cutting-edge technologies, nurturing innovation and encouraging more sustainable practices. These actions are carried out with the overarching aim of spurring Malaysia’s capital market and contributing to the nation’s development.

Global Investor

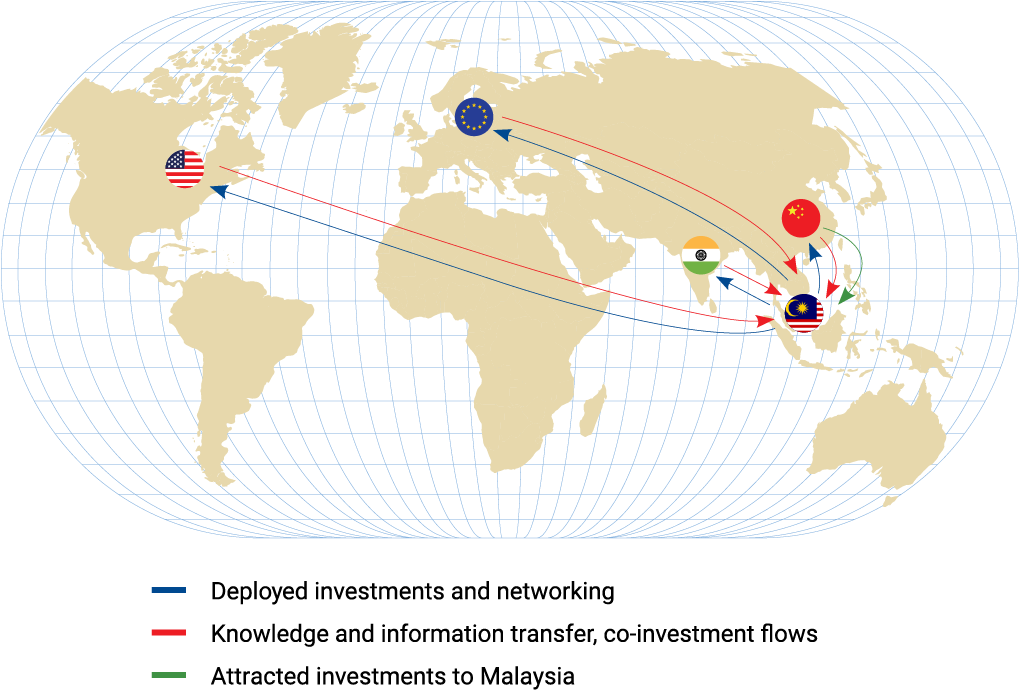

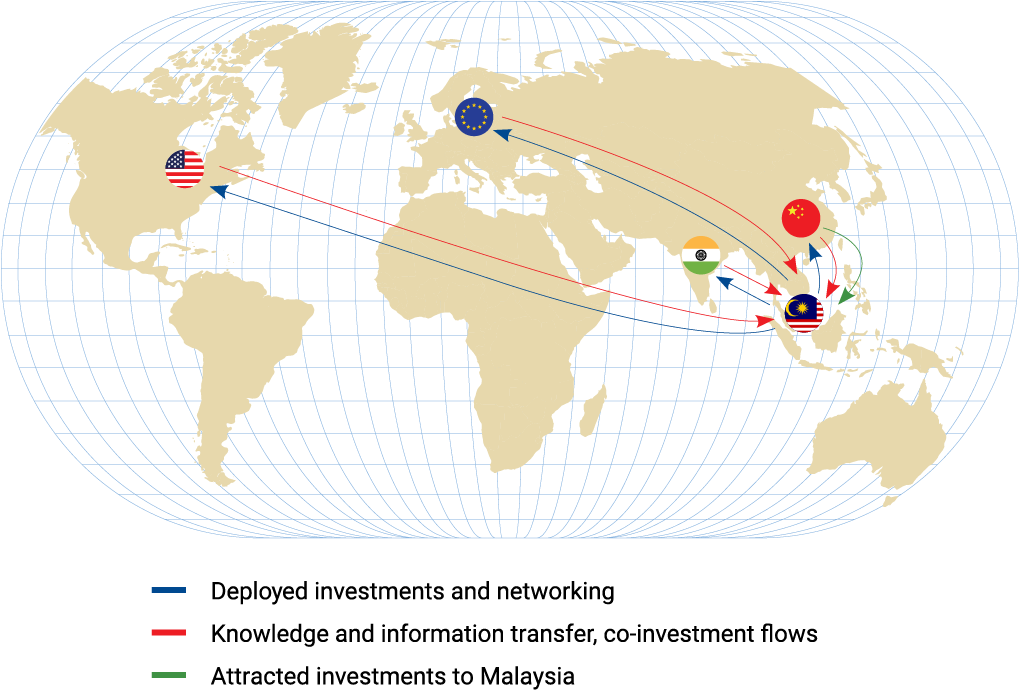

Our international investments span a wide range of asset classes and markets. We strategically align these investments with global megatrends and emerging technologies, serving the twin goals of growing our portfolio value and facilitating flows of knowledge, networks and investment opportunities to Malaysia.

Building Capacity and Vibrant Communities

Build capacity and develop vibrant communities for the benefit of Malaysians through our activities and via our affiliated entities such as Yayasan Hasanah, Khazanah Research Institute, Taman Tugu, Think City, Yayasan Khazanah, Khazanah Megatrends Forum and Galeri Khazanah.

Dana Impak

Dana Impak (our impact fund) is a RM6 billion commitment over five years to invest in catalytic sectors that will increase the nation’s competitiveness and build its resilience. Investments under Dana Impak are guided by six themes:

- Digital Society and Technology Hub

- Food and Energy Security

- Decent Work and Social Mobility

- Quality Health and Education for all

- Building Climate Resilience

- Competing in Global Markets

We participate in Malaysia’s capital markets as an active shareholder, encouraging our investee companies to create value by crowding-in new private investments and driving regulatory improvements, all while promoting the adoption of cutting-edge technologies, nurturing innovation and encouraging more sustainable practices. These actions are carried out with the overarching aim of spurring Malaysia’s capital market and contributing to the nation’s development.

Our international investments span a wide range of asset classes and markets. We strategically align these investments with global megatrends and emerging technologies, serving the twin goals of growing our portfolio value and facilitating flows of knowledge, networks and investment opportunities to Malaysia.

Building Capacity and Vibrant Communities

Build capacity and develop vibrant communities for the benefit of Malaysians through our activities and via our affiliated entities such as Yayasan Hasanah, Khazanah Research Institute, Taman Tugu, Think City, Yayasan Khazanah, Khazanah Megatrends Forum and Galeri Khazanah.

Our Core Values

They guide us in our conduct, shape our culture and define us as an organisation, and how we operate with one another, partners and stakeholders.

We hold ourselves

accountable

We respect different

viewpoints

We support one

another