Press Releases

18 January 2011

Seventh Khazanah Annual Review 2011

- Record Financial Performance

- Portfolio Realisable Asset Value (“RAV”) and Net Worth Adjusted (“NWA”) jumped by RM21 billion to RM112.6 billion (+23.5%) and RM75.0 billion (+39.4%) respectivelyo NWA has risen by RM41.7 billion or 125% since May 2004, a CAGR of 13% per annum

- Portfolio performance has outperformed KLCI and most regional benchmarks in 2010

- Eventful year of major transactions and significant progress in executing strategic mandate

- Focus for 2011 firmly on Execution and Institutionalisation

Over an eventful year1, Khazanah Nasional Berhad (“Khazanah”) today reported significant progress on both its financial and strategic performance for 2010 at the Khazanah Annual Review 2011 (“KAR 2011”). The Review also outlined the outlook and focus areas for Khazanah in 2011. Key highlights are:

1. FINANCIAL PERFORMANCE IN 2010

The year 2010 has been a sterling 12-month period in terms of financial performance with Khazanah recording all-time highs across all key financial and investment portfolio indicators.

The highlights include:

- Investment portfolio rose significantly with overall portfolio Realisable Asset Value (“RAV”) rising by RM21.4 billion or 23.5% year-on-year to RM112.6 billion as at 31st December 2010 (31st December 2009: RM91.2 billion). Net Worth Adjusted2 (“NWA”) jumped RM21.2 billion or 39.4% to RM75 billion jumped RM21.2 billion or 39.4% to RM75 billion (31st December 2009: RM53.8 billion).

- Compared against the starting point of Khazanah’s transformation programme in May 2004, both RAV and NWA have more than doubled by 121.2% and 125.2%, respectively. (14th May 2004: RAV RM50.9 billion, NWA RM33.3 billion). For NWA, this translates into a CAGR over the period to 31st December 2010 of 13.0% p.a.

- The increase in NWA of 39.4% and the total shareholder return (“TSR”) of the listed portfolio of Khazanah for 2010 was at 33.4%, considerably outperforming KLCI’s TSR of 23.3%.

- The combination of rising asset values and stable and prudent liability position resulted in an overall stronger financial position, with the total assets over total liability cover strengthening to 2.9 times as at 31st December 2010 (2009: 2.4 times).

- Overall net investment stance was neutral in 2010, with a total of RM6.5 billion of investments (over 12 transactions) and RM6.2 billion of divestments (over 7 transactions). The RM6.2 billion of divestments generated gains of divestments amounting to RM3.5 billion.

- The year 2010 saw several key investment and financing transactions that were significant milestones for Khazanah. Selected transactions include, inter alia;

- The takeover of Parkway Holdings for SGD2.5 billion (RM5.95 billion), financed by the issuance of Khazanah’s biggest sukuk issue to-date, involving a five-year and a 10-year sukuk totaling SGD1.5 billion (RM3.6 billion).

- The privatisation of Astro All Asia Networks plc for RM8.5 billion in partnership with Usaha Tegas.

- A collaborative investment partnership with the non-GLC private sector in developing Teluk Datai, Langkawi with commitments of more than RM1 billion.

- A 5% investment into Sustainable Development investment of GBP1.86 million (RM9.1 million) into Camco International, and joint venture valued at USD30 million (RM92.7 million) to form Camco South-East Asia, to invest in clean energy projects.

- In the past 12 months, Khazanah continued its gradual divestment programme of non-core holdings and non-core assets. During the year, Khazanah sold or reduced its holdings in Malaysia Airports Holdings Berhad, Telekom Malaysia Berhad (“TM”), DRB-Hicom and CIMB Group Berhad. In addition, during 2010, Khazanah has announced or is in the process of executing the divestment of several significant stakes in EON Capital Berhad, PLUS Expressways Berhad and POS Malaysia Berhad.

2. STRATEGIC & OPERATIONAL PERFORMANCE

On the strategic and operational front, we believe significant inroads were made in 2010, in executing existing and ongoing programmes such as the GLC Transformation Programme, the regionalization of GLCs and Iskandar Malaysia, and also in supporting the various national transformation programmes under the New Economic Model (“NEM”).

- Six and half years into the GLCT Programme, GLCs are firmly on a growth trajectory having demonstrated resilience throughout the Global Financial Crisis of 2008/2009. Aggregate earnings of the G-203 in 2010 is forecast to touch the previous peak of RM19.3 billion in 2007, and to rise further in 2011. Market capitalisation of the G-20 has also reached an all-time high of RM343 billion as at 31st December 2010. The G-20 has also risen by an annual TSR of 16.3% outperforming the rest of the KLCI by 2.2% per annum. Meanwhile, the nine companies controlled by Khazanah within the G-20 has posted a TSR of 17.4% per annum, outperforming the rest of KLCI by 3.4% per annum.

- The year 2010 also saw the continuation of collaborative partnerships between Khazanah and private companies, as well as between GLCs under Khazanah and non-GLCs. Notable examples include the development of Teluk Datai Resorts; the privatisation of Astro; the UEM Land Holdings Berhad takeover of Sunrise Berhad; the joint bid by UEM and EPF to takeover PLUS Expressways and most recently, TM’s open platform for national broadband and the signing of a 10-year access agreement with Maxis Berhad.

- Iskandar Malaysia continued to show steady progress with overall cumulative investment commitments rising to RM64 billion in 2010 (2009: RM56 billion). More significantly, 42% of the investment commitments are already at various stages of roll-out. Khazanah remains a significant driver of activity through its direct investments and developments undertaken by major subsidiaries Iskandar Investment Berhad and UEM Land Berhad.

- In March 2010 at the launch of the NEM, Khazanah, in its role as the secretariat of the Putrajaya Committee for GLC High Performance (“PCG”) announced five major roles for GLCs and Government Linked Investment Companies (“GLICs”), reiterated here as follows;

- Diligently continuing the organic improvements under the 10-year GLC Transformation (“GLCT”) Programme

- Relentlessly executing and driving the GLCs to become regional champions.

- Pioneering investments in new economy and knowledge based sectors, in line with the NEM.

- Collaboration and co-investment combinations between GLCs and non-GLCs, both at home and abroad.

- Continuing the focus on core operations on a level playing field and exiting non-core and non-competitive assets and holdings

- Khazanah and companies controlled by it continues to contribute significantly to various national transformation initiatives including the early formation of Pemandu and the Government Transformation Programme (“GTP”) and in 9 out of the 12 National Key Economic Areas (“NKEAs”) of the Economic Transformation Programme (“ETP”).

- Khazanah’s corporate responsibility, human capital development and knowledge development activities showed steady progress in 20104. In addition to ongoing programmes such as under Yayasan Khazanah; school adoption under Yayasan PINTAR, improving the livelihood of the lower-income group under Yayasan Sejahtera, and enhancing graduates’ employability in the Graduate Employability Management Scheme (“GEMS”), two new programmes were launched in 2010. Both initiatives were in the area of improving the education system with the Trust School Network under Yayasan Amir and Teach For Malaysia. The work on knowledge development continued further under our flagship events including the Khazanah Global Lectures and the Khazanah Megatrends Forum.

3. OUTLOOK AND FOCUS FOR 2011

Khazanah’s focus for 2011 is principally in execution and institutionalisation under three broad areas:

- Financial portfolio value creation: Khazanah will continue to create value at its portfolio companies by various ongoing value creation initiatives, through active Monitoring & Management (“M&M”), GLC Transformation, resolving Restructuring & Reorganisation (“R&R”) cases and driving ongoing regionalization. In addition, we expect to continue with the gradual divestment programme of non-core assets and non-core holdings, and strategic divestments of selected companies; as well as maintaining prudent and innovative liability management.

- Strategic value creation through catalytic activities: In addition to the various core investment and divestment initiatives, execution focus will continue to be on various catalytic investment modalities. This includes the execution of various NEIs in various selected high-impact sectors, intensifying the co-investment and collaborative strategy demonstrated in 2010, and continued support to the Government, as required, of various national transformation programmes which include GTP, ETP and NEM and the formation of the Talent Corporation.

- Institutionalisation – two-thirds way through a 10-year Khazanah revamp programme: Khazanah will continue its on-going efforts to develop systems, controls, and risk management capabilities; efforts related to human capital development and strengthening of corporate culture; and initiatives related to the building of Khazanah into a learning organisation.

END

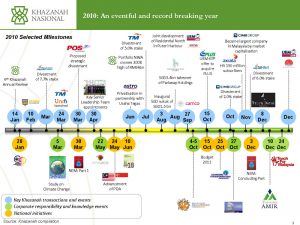

- Appendix 1 summarizes in graphical form the key milestones and events for 2010

- Net Worth Adjusted is defined as RAV less Total Liabilities and adjusted for equity injections less dividends paid.

- A selection of 20 largest and most significant GLCs controlled by Government Linked Investment Companies (GLICs) constituents of the Putrajaya Committee on GLC High Performance. The G-20 currently consists of 19 GLCs, following the Sime Darby mergers and TM/ Axiata demerger. UEM Group has replaced UEM World following UEM’s restructuring

- Khazanah’s Corporate Responsibility Report for 2010 is also launched at KAR 2011

APPENDIX 1

2010: An evenful and record breaking year